How to apply for Chase Bank Freedom Unlimited Credit Card

Chase Bank is offering Freedom Unlimited Credit Card for the consumers. JP Morgan Chase Bank is also known as Chase Bank is an American multinational financial service holding company, based in New York City. With Chase Bank Freedom Unlimited Credit Card, you could earn unlimited bonus points as rewards and get exclusive deals and benefits that tailored according to your needs. Chase Bank also allows you to earn cashback for referring every friend for the Chase Freedom Unlimited credit card. To know more about the Freedom Unlimited Credit card, you could go through the following article.

What are the products and services offers by the Chase Bank:

-

Credits cards

-

Refinancing a loan

-

Personal banking

-

Military banking

-

Checking accounts

-

Debits cards

-

Digital banking

-

Savings account and Certificated of deposits

-

Private banking

-

Planning and investment

-

Home equity line of credit

-

Mortgages

-

Mortgages refinancing

How many different types of Credit cards are offered by the Chase Bank:

-

Freedom Unlimited Credit Card

-

Freedom Credit Card

-

Sapphire Preferred Credit Card

-

Sapphire Reserve Credit Card

-

Southwest Rapid Rewards Priority Credit Card

-

Southwest Rapid Rewards Plus Credit Card

-

Southwest Rapid Rewards Premier Credit Card

-

United Club Infinite Card

-

United Explorer Card

-

United TravelBank Card

-

British Airways Visa Signature Card

-

Aer Lingus Visa Signature Card

-

Iberia Visa Signature Card

-

Marriott Bonvoy Boundless Credit Card

-

Marriott Bonvoy Bold Credit Card

-

World Of Hyatt Credit Card

-

Disney Premier Visa Card

-

Disney Visa Card

-

IHG Rewards Club Premier Credit Card

-

IHG Rewards Club Traveler Credit Card

-

Starbuck Rewards Visa Card

-

Amazon Prime Rewards Visa Signature Card

-

AARP Credit Card from Chase

-

Ink Business Unlimited Credit Card

-

Ink Business Cash Credit Card

-

Ink Business Preferred Credit Card

-

United Business Card

-

Southwest Rapid Rewards Performance Business Credit Card

What are the benefits of the Freedom Unlimited Credit Card from Chase Bank:

-

With Freedom Unlimited Credit Card, the new cardmember could earn $200 cashback within the 90 days from the date of account opening, after spending $500 on purchases.

-

You could earn 1.5% unlimited cash back on every purchase you will make.

-

There is no annual maintenance fee for your Freedom Unlimited Credit card.

-

You will be charged 0% APR on purchases for the first 15 months.

-

Your cashback rewards points do not expire until you maintain your Chase Bank account.

-

You could shop your rewards points at Amazon.com to pay for all or part of your eligible orders at checkout.

-

You could redeem your points for a variety of gift card, for shopping, movies, dining, etc.

-

You could also redeem your rewards points for travel bookings by paying competitive rates.

-

You could redeem your rewards points as a statement credit or direct deposit to your checking or savings account.

-

You will get credit card purchase protection for new purchases against $50,000 per account.

-

You will get extended warranty protection for the U.S manufacturer’s warranty by an additional year.

-

You will get personalized account alerts and covered under fraud protection.

-

You will get covered for zero liability protection, in case if any unauthorized transaction takes place from your account.

-

With your Freedom Unlimited credit card, you could pay just by tapping, for fast, easy and secure checkout.

-

You will get 3 months complimentary DoorDash’s subscription for unlimited deliveries for a $0 delivery fee on DoorDash order over $12.

-

You could also earn 5% cashback on Lyft rides up to march 2022.

How to apply for the Freedom Unlimited credit card from Chase Bank through the invitation offer:

-

To, apply for the Freedom Unlimited credit card from Chase Bank through the invitation offer, you could visit the following page www.getfreedomunlimited.com

-

After that, you will be asked to enter the following info.

12- Digit Invitation Number

5-digit Zipcode

Last name

-

And, click “Submit” to proceed further

-

After, authenticating your above details, and going through a couple of steps, you could be able to apply for the Freedom Unlimited Credit Card.

How to apply for the Freedom Unlimited credit card from Chase Bank without an invitation offer:

-

To, apply for the Freedom Unlimited credit card from Chase Bank without an invitation offer, you could visit the following page creditcards.chase.com/cash-back-credit-cards/freedom/unlimited

-

You could apply by signing to your existing Chase bank account for faster apply or else apply as a guest.

-

If you choose to apply as a guest

-

You will be required to enter the following info.

First name

Last name

Mailing address

City

State

Zipcode

Date of Birth

Mother’s Maiden Name

Email address

Social security number/ Income tax identification number

Total gross annual income

Type of residence

The primary source of income

Primary phone number

If you want to add an authorized user?

-

And, click the “Submit” button after checking the “Terms and condition” checkbox and “E-sign Disclosure”

-

After confirming your identity and going through a couple of steps, you could be able to apply for the Freedom Unlimited credit card.

-

After confirming your eligibility by the Chase Bank you will be acknowledged about your credit card status.

What are the charges for the Unlimited Freedom Credit Card:

-

You will be charged 0% APR for purchase for the first 15 months, thereafter you will be charged 14.99% to 23.74% APR, based on your creditworthiness and the market rate.

-

You could be charged 0%APR for a balance transfer for the first 15 months, thereafter you will be charged 14.99% to 23.74% APR, based on your creditworthiness and the market rate.

-

You could be charged 24.99% APR for cash advances, based on the market rate.

-

To avoid paying interest, you should pay your all dues within after 21 days from the close of each billing cycle.

-

There will be no annual membership fee for your Freedom Unlimited Credit Card.

-

You could be charged for each balance transfer either 3% or $5 of the amount for the first 60 days, thereafter you will be charged either $5 or 5% whichever will be the greater.

-

You could be charged for each cash advances either 5% or $10 of the amount, whichever will be the greater.

-

You could be charged 3% for the amount of each foreign transaction as a fee.

-

And, you could be charged up to $39 for late and returned payment

How to login to your chase bank Freedom Unlimited credit card account:

-

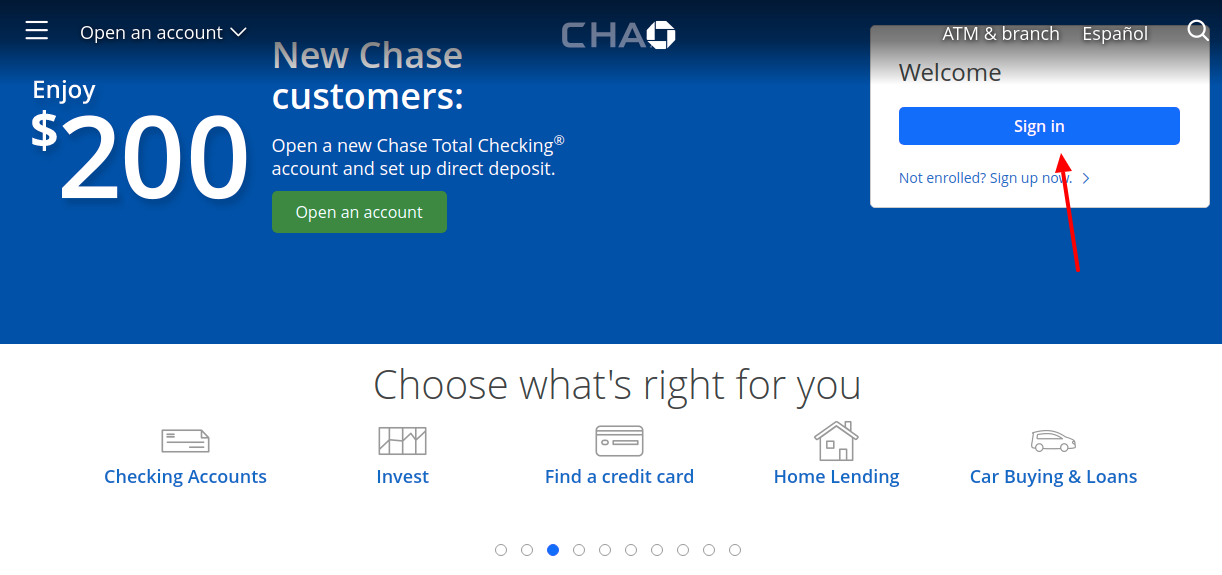

To, login to your chase bank Freedom Unlimited credit card account, you could visit the following page www.chase.com

-

Now, click on the “Sign in” button

-

After that, you will be required to enter your “Username” and “Password”

-

And, click “Sign in”

-

After validating your login credentials, you could be able to sign in to your Freedom Unlimited Credit Card account.

How to reset your Chase Bank Freedom Unlimited credit card account username/password:

-

To, reset your Chase Bank Freedom Unlimited credit card account username/password, you could visit the following page www.chase.com

-

Now, click on the “Sign in” button

-

Here, you could click on the alternative link “Forgot username/password” which is provided immediately below the Sign-in button

-

Thereafter, you will be asked to enter your account following details

Social security number/ Tax ID number

Select your account type

-

And, click “Next” to proceed further

-

After that, you need to go through a couple of steps to verify your login credentials.

-

After authenticating your account login credentials, you could be able to reset your Chase Bank Freedom Unlimited Credit Card account username/password.

If you need any further assistance or have any queries, regarding the Freedom Unlimited credit card you could contact Chase Bank through the following.

Also Read : Manage Your JC Penney MasterCard

How to contact Chase Bank:

-

You can visit your nearest Chase Bank branch to get a quick response

-

You can also reach to their customer support representative over the phone, dial

Personal Credit Cards

Customer Service: 1-800-432-3117

International: 1-302-594-8200

Business Credit Cards

Customer Service: 1-888-269-8690

International: 1-480-350-7099

Have a speech disability, call 711 for assistance

Chase Military Services at (877) 469-0110

-

You can write to Chase bank at the following address also

Credit Card Payments

Cardmember Services

P.O. Box 6294

Carol Stream, IL 60197-6294

General Correspondence

Card Service

P.O. Box 15298

Wilmington, DE 19850

SCRA Request

P.O. Box 183240

Columbus, OH 43218-3240

Card Credit Bureau Disputes

Card Services

Credit Bureau Dispute Processing

PO Box 15369

Wilmington, DE 19850-5369

-

And, you could follow Chase Bank through their social media handler

Facebook – www.facebook.com/chase

Twitter – twitter.com/Chase

YouTube – www.youtube.com/chase

Instagram – www.instagram.com/chase

Pinterest – www.pinterest.com/chase

Reference – www.getfreedomunlimited.com