About CoServ

CoServ is an electricity and natural gas service provider. In 1937, this company was first started. This company is a non for profit rural cooperative company. They serve throughout Dallas, Texas. They serve over 130,000 gas meters in Kaufman, Denton, and Colin. They provide electricity and natural gas services at a very affordable price.

How to Pay CoServ Bill

You will get several payment options to pay your CoServ bill. You can make your payment by following these methods below:

Pay CoServ Bill by Online Payment:

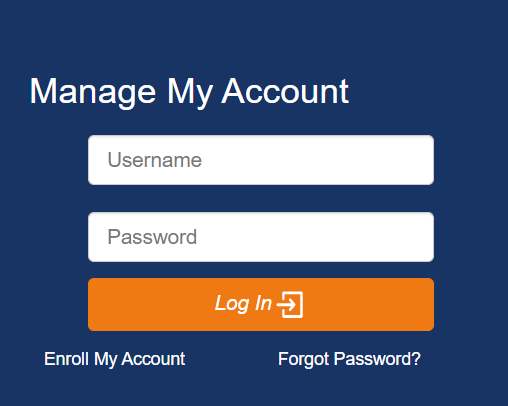

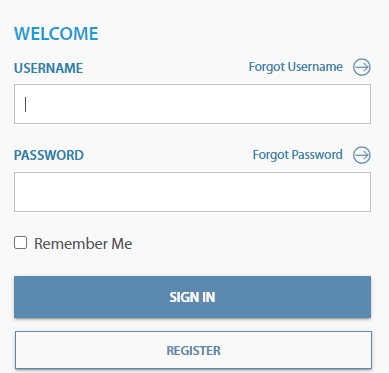

- Make payment for the CoServ bill through the online payment option. But, before start making a payment, sign up your account first. If you already completed the signup process, then follow these steps:

- Simply go to this link coserv.smarthub.coop

- Then, on the provided field, simply input your email ID and password.

- To save your email address on your device, tick the Remember Me box.

- After providing your login details, click on the Login option.

- After that, follow the steps further to make your bill payment.

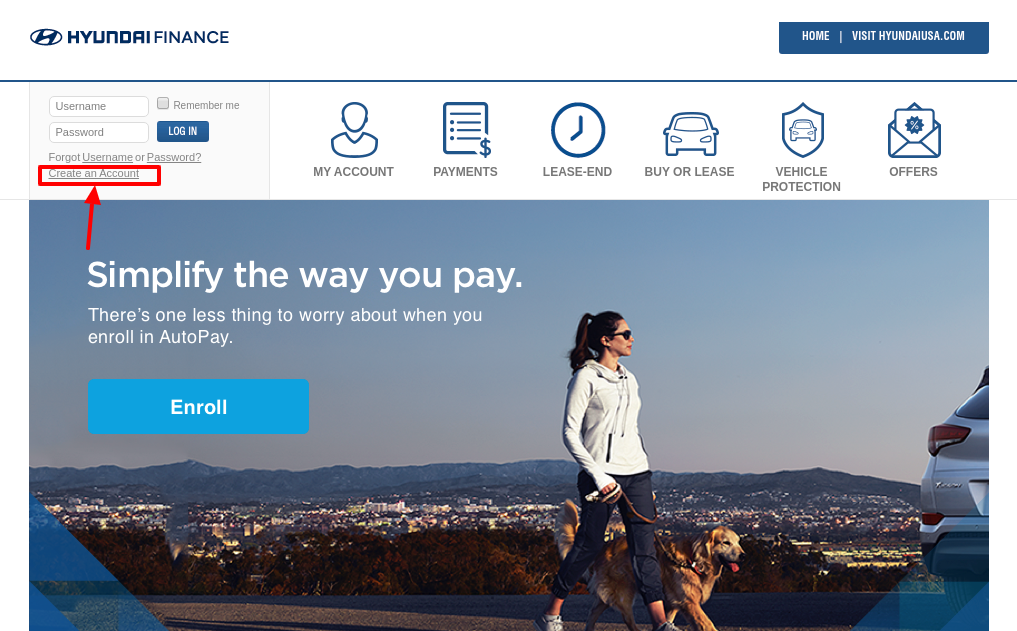

Pay CoServ Bill by AutoPay:

- AutoPay allows the customers to pay their CoServ bill automatically from a checking account, credit/debit card. You have to enroll in AutoPay to pay your bill automatically. To enroll for AutoPay, follow these steps:

- You have to go to this link coserv.smarthub.coop

- Then, on the provided field, simply input your email ID and password.

- Then, under the Billing & Payments option, select the AutoPay Program.

- After that, you need to look for AutoPay set up.

Pay CoServ Bill by Mail:

- Through the traditional mail method, you can pay your CoServ utility bill. Send your money order or personal check by mail to CoServ. The mail payment will take time to proceed. While sending your mail, you need to include the CoServ account number on your check or money order. You can use this payment address to make the payment:

CoServ

P.O. Box 734803

Dallas, TX 75373-4803.

CoServ Bill Payment by Phone:

Users can also pay the CoServ bill over the phone. You can choose to pay your bill through an automated phone system. To make the payment, you need to dial (833) 890-6264 or (833) 890-4831 from your phone. You will require your account number to make your bill payment. There will be no additional fees for making payments over the phone.

CoServ Bill by Payment MoneyGram:

You can pay your CoServ bill at MoneyGram locations. For making payment, you have to pay a transaction fee. To make the bill payment, you will require your payment, account number, and the received code 18863. To find the MoneyGram locations visit this link www.moneygram.com

How the Penalty Fees Work

- These are the following fees you will be charged with the CoServ bill.

- Late Payment Fees: If you cannot make your bill payment by the due date, you have to pay the late payment fees. For the late payment fees, you have to pay 5% of the past due balance.

- Deposit: You have to pay a security deposit.

- Returned Check Fee: If the bank refuses the check, then you have to pay the returned check fees. For the returned check fees, you have to pay $25.

- Reconnect Fee: For the reconnect fees, you have to pay $100.

What to Do If You Can’t Pay the Bill

- You will get the following options if you cannot make your bill payment.

- Lenient Billing: CoServ allows its customers to pay their bill 47 days from the time a bill is sent. This extra time may help the customers to complete the payment.

- LIHEAP: If you are a qualified low-income customer, then you can apply for the LIHEAP.

Read More : Idaho Power Online Bill Pay

CoServ Contact Info

In case, you need to contact the CoServ customer service department, then contact at:

Email At: contact@coserv.com

Call At: (940) 321-7800

Reference Link